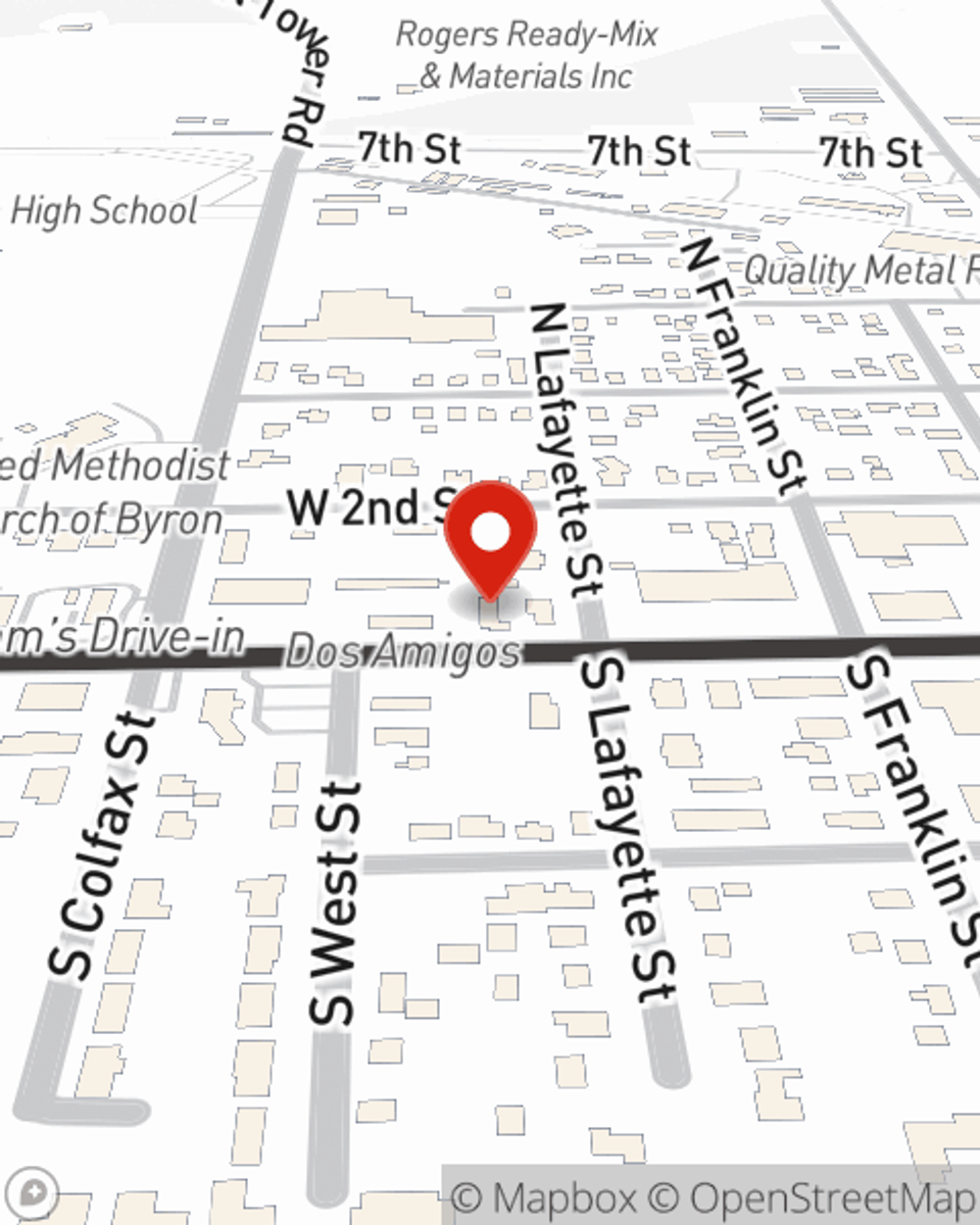

Business Insurance in and around Byron

Byron! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Insure The Business You've Built.

Running a small business is no joke. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of contractors, trades, specialized professions and more!

Byron! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

Every small business is unique and faces specific challenges. Whether you are growing a clock shop or a bagel shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your layout, you may need more than just business property insurance. State Farm Agent Gregg Marinelli can help with business continuity plans as well as mobile property insurance.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Gregg Marinelli is here to help you discuss your options. Get in touch today!

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Gregg Marinelli

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.